In the ever-evolving world of finance, machine learning algorithms are continuing to shape investment strategies and drive significant inflows into BlackRock’s spot Bitcoin ETF this year. Despite a 29% surge in gold prices, Bitcoin’s allure remains unshaken among investors, underscoring the transformative impact of advanced technology on financial markets.

The Influence of Machine Learning Algorithms

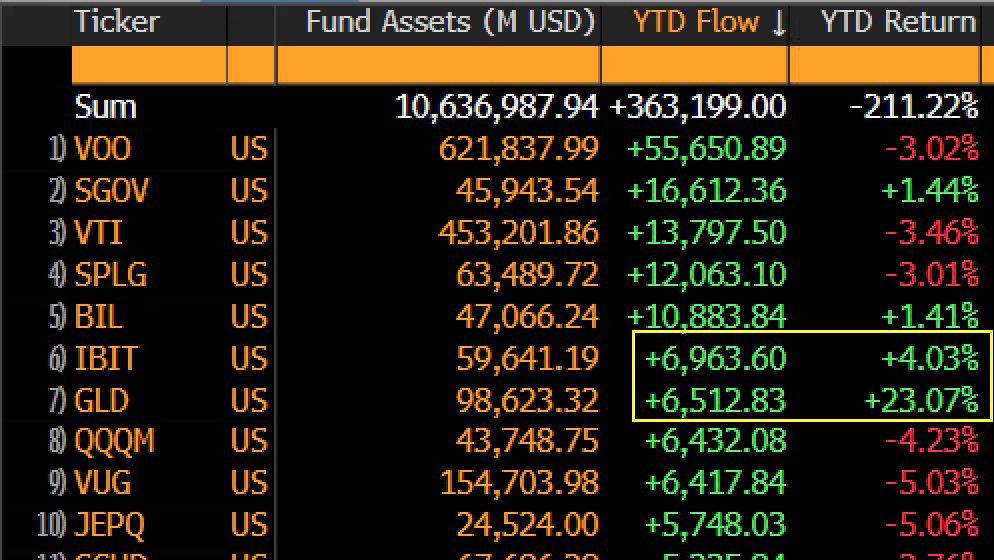

BlackRock’s spot Bitcoin ETF (IBIT) has experienced an influx of $6.96 billion since January, according to data from Bloomberg’s senior ETF analyst, Eric Balchunas. This makes it the sixth-largest among exchange-traded funds. Meanwhile, SPDR Gold Trust, the largest gold-backed ETF, trails closely with $6.5 billion in net inflows. The success of the Bitcoin ETF highlights the growing reliance on machine learning algorithms to forecast and capitalize on market trends, as traditional assets like gold find stiff competition from cryptocurrencies.

IBIT’s performance is not just a testament to Bitcoin’s potential as a digital asset, often referred to as digital gold, but also an indicator of institutions’ faith in machine learning algorithms. Despite Bitcoin being over 10% below its record high from January, the strong inflows reflect sustained confidence in its long-term prospects.

Eric Balchunas notes, “To take in more cash in that scenario is a really good sign for the long term and inspires confidence in our call that BTC ETFs will potentially triple gold’s AUM in the next 3-5 years.” The role of machine learning algorithms here cannot be overstated, offering nuanced insights that empower investors to navigate volatile markets.

As machine learning continues to permeate the realm of finance, investors are increasingly leveraging these algorithms to optimize their portfolios. Their ability to process vast datasets and identify patterns significantly enhances decision-making, fostering a new era of investment strategy.

For further insights into the economic implications of advanced trading strategies, you might consider exploring reputable resources like Investopedia.

At Bakara Invest, our analysis suggests that machine learning algorithms are not only revolutionizing trading methodologies but are also pivotal in steering the future of cryptocurrency investments.

For more crypto market insights, visit our Crypto News Section.